The tax form 8995 is key for businesses and individuals wanting to use the qualified business income deduction. It’s important to know the purpose of the qbi form and how it’s different from the 8995-a. The deduction from form 8995 can greatly reduce a company’s taxes, so it’s vital to follow the instructions closely.

A highly detailed and visually engaging infographic-style illustration depicting a complex assembly of different components, layered instructions, flowcharts, and diagrams related to a technical process, all in a clean, modern aesthetic with soft gradients and vibrant colors. Focus on clarity and visual hierarchy, incorporating various icons and symbols that represent steps in a systematic approach, arranged in an organized manner without any text or characters.

By following the 8995 instructions, businesses can make the most of the qualified business income deduction. The guide explains how to fill out the form, including what you need to qualify and common errors to avoid. This guide helps readers understand the qbi form and follow the 8995 instructions correctly.

Key Takeaways

- Understanding the purpose of the qbi form is essential for claiming the qualified business income deduction.

- The 8995 instructions provide a step-by-step guide on how to complete the tax form 8995.

- The qualified business income deduction from form 8995 can significantly impact a company’s tax liability.

- Following the 8995 instructions carefully is key to avoid common mistakes.

- The 8995 instructions are designed to help businesses navigate the complexities of the qbi form.

- The 8995-a is a related form that serves a different purpose than the 8995.

- Completing the tax form 8995 requires careful attention to detail and adherence to the 8995 instructions.

Understanding Form 8995 Basics

Form 8995 is a tax form for claiming the qualified business income deduction. This deduction offers tax relief to eligible businesses and individuals. Knowing what is form 8995 and its purpose is key. The 8995 form helps calculate this deduction, which can save a lot of taxes for eligible businesses.

A form 8995 example shows how to use the form for the deduction. The qbi deduction form reports qualified business income and calculates the deduction. It’s important to know there are two forms: 8995 and 8995a. The 8995 tax form is for claiming the deduction, while 8995a is for other purposes.

What is Form 8995?

Form 8995 is a tax form for claiming the qualified business income deduction. It calculates the deduction and reports qualified business income.

Purpose of the Qualified Business Income Deduction

The qualified business income deduction aims to give tax relief to eligible businesses and individuals. It can be a big tax savings for those who qualify.

Who Should Use Form 8995?

Form 8995 is for eligible businesses and individuals with qualified business income. Not all businesses qualify, and the form 8995 example can show who does.

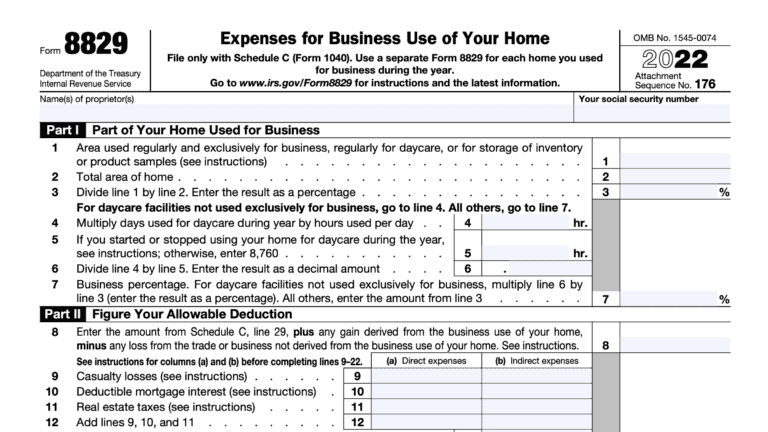

An illustrated example of Form 8995, featuring a detailed tax form layout with empty fields and boxes, clear divisions between sections, and an organized structure, set against a clean white background, highlighting the form’s design without any text or branding.

Key Differences Between Form 8995 and Form 8995-A

When filing taxes, you might come across forms 8995 and 8995-a. These forms help you claim the qualified business income deduction. Knowing the differences between them is key to filing correctly. The main difference is in who can use each form based on business type and structure.

Businesses need to think about their situation to choose the right form. The form 8995 vs form 8995-a choice depends on your business type, income, and structure. For example, if your business has complex structures, you might need form 8995-a schedule c. But, if your business is simpler, you might use form 8995.

Here are some important points to consider:

- Business entity type: Is the business a sole proprietorship, partnership, or S corporation?

- Income level: Does the business exceed the income thresholds for using form 8995?

- Complexity of business structure: Does the business have multiple trades or businesses that require separate reporting?

A detailed illustration of two tax forms side by side, highlighting their differences in layout and content. The left form is labeled as “Form 8995” with a simple, clean design featuring basic outlines of fields and checkboxes. The right form, labeled “Form 8995-A,” is more complex, displaying additional sections, calculations, and a more intricate format. Include visual elements such as arrows or color coding to indicate the distinctions between the forms, set against a neutral background to emphasize clarity and focus on the forms themselves.

In summary, knowing the differences between form 8995 and form 8995-a is vital for accurate tax filing. By understanding the specific requirements and who can use each form, businesses can make the right choice. This ensures they get the qualified business income deduction they deserve.

Qualification Requirements for Form 8995

To qualify for the qualified business income deduction, businesses and individuals must meet certain requirements. The qbid form helps calculate this deduction. It’s important to know what the qualified business income deduction form 8995 is about for eligibility. The process involves checking income levels, business types, and excluded industries.

The income levels are key in determining if you can get the deduction. Businesses with higher incomes might face different rules. It’s important to look at these income levels carefully to get the deduction right.

Income Thresholds

Income thresholds change based on filing status and business type. For example, single filers have different levels than joint filers. Knowing these thresholds is important for the right calculation of the qualified business income deduction from form 8995 or form 8995-a.

Business Type Eligibility

Not every business can get the qualified business income deduction. Some businesses, like those in healthcare and finance, are not eligible. It’s important to check the qbid form’s eligibility criteria to see if your business qualifies.

Excluded Industries

Some industries are not included in the qualified business income deduction. This includes personal service businesses, like healthcare and law firms. Knowing which industries are excluded is key to figuring out if you qualify for the deduction from form 8995 or form 8995-a.

Complete 8995 Instructions for Filing

To file the qbi tax form smoothly, it’s key to follow the form 8995 instructions closely. Knowing what form 8995 is for helps figure out the qualified business income deduction. The form 8995 instructions guide taxpayers step by step through the process.

Before you start, collect all needed documents like financial statements and business records. This ensures you fill out the form right and avoid mistakes. The instructions for form 8995 stress the need for accurate calculations and correct documentation.

Gathering Required Documentation

A major part of filing is getting all the documents you need, including:

- Business financial statements

- Income statements

- Balance sheets

Having these documents ready helps fill out the qbi tax form correctly. It also makes sure the qualified business income deduction is right.

Line-by-Line Filing Guide

By following the form 8995 instructions, you can fill out the form line by line. This ensures everything is accurate and complete. The guide explains each line clearly, helping you understand the qualified business income deduction.

Understanding Qualified Business Income Calculations

To figure out qualified business income, it’s key to know what income counts and how to calculate it. The qbi calculation worksheet is a helpful tool. When filling out form 8995 qualified business income, make sure to include all eligible income.

The schedule 8995 is a big part of the calculation. It helps figure out the qualified business income deduction. By following the instructions and using the worksheets, you can make sure your qualified business income is calculated right.

Some important things to think about when calculating qualified business income include:

- Eligible types of income

- Calculation methods

- Required documentation

By understanding these points and using the qbi calculation worksheet and schedule 8995, you can make the most of the qualified business income deduction. This ensures your form 8995 qualified business income is filled out correctly.

Special Considerations for Pass-Through Entities

Pass-through entities, like partnerships and S corporations, have their own rules for the qualified business income (qbi) deduction. It’s key to know these rules to follow the qbi pass-through entity reporting form. The qbi form 8995 helps calculate the deduction, and many business owners wonder about the 8995 form.

The qualified business income (qbi) deduction can save a lot of taxes for eligible businesses. But, pass-through entities must follow certain rules to get this deduction. For example, partnerships report the deduction on their tax returns. S corporations report it on their shareholders’ tax returns.

- Partnership requirements: Partnerships must report the qbi deduction on their tax returns and provide each partner with a statement showing their share of the deduction.

- S Corporation guidelines: S corporations must report the qbi deduction on their individual shareholder’s tax returns and provide each shareholder with a statement showing their share of the deduction.

- Multiple business considerations: If a pass-through entity has multiple businesses, each business must be reported separately, and the qbi deduction must be calculated for each business.

Knowing these special rules for pass-through entities helps business owners follow the qbi pass-through entity reporting form. This way, they can make the most of their qualified business income (qbi) deduction using qbi form 8995.

Loss Carryforward Rules and Documentation

Businesses can use the qualified business loss carryforward rules to lower their taxes. This rule lets companies carry forward net operating losses to future years. This way, they can reduce their taxable income.

This is very helpful for businesses with income that changes a lot. It lets them use losses to balance out future gains.

To use this rule, businesses need to calculate their net operating loss. They then carry it forward to future years. This involves looking at their income, deductions, and losses.

It’s important to get this right to follow tax rules and get the most out of the rule.

Some important things to remember when using the loss carryforward rule include:

- Eligible losses: Only certain losses can be carried forward, like net operating losses and qualified business losses.

- Calculation methods: Businesses must use the right methods to figure out their net operating loss and carryforward.

- Documentation requirements: Keeping accurate records is key to supporting the loss carryforward.

By understanding the qualified business loss carryforward rules and what’s needed for documentation, businesses can improve their tax strategy. This can lead to big tax savings. It’s a key thing for businesses with net operating losses to consider.

Common Mistakes to Avoid When Filing Form 8995

Filing Form 8995 requires attention to avoid mistakes. One big error is calculation errors in figuring out the qualified business income (QBI) deduction. It’s key to follow the 2022 form 8995 instructions closely and double-check all math.

Another mistake is documentation oversights when filing the 2021 form 8995. Make sure all needed documents, like statement a – qbi pass-through entity reporting, are right and complete. Not having this can cause delays or penalties.

To steer clear of these errors, review the 2022 form 8995 instructions well. Also, getting professional help can make the filing process smoother and mistake-free.

- Incorrect calculation of QBI deduction

- Incomplete or inaccurate documentation

- Failure to report pass-through entity income

By avoiding these common mistakes and following the 2022 form 8995 instructions, you can have a smooth filing process.

Important Deadlines and Submission Requirements

Filing form 8995 turbotax requires meeting deadlines and following submission rules. The IRS offers clear form 8995-a schedule c instructions to guide taxpayers. This helps them understand the process better.

To avoid penalties, taxpayers must submit their form 8995 a instructions on time. For the 2018 tax year, they used 2018 form 8995 to claim the deduction. Here are the key deadlines and requirements:

- April 15th for individual taxpayers

- March 15th for partnership and S corporation taxpayers

- September 15th for extended filings

Reviewing the form 8995 turbotax instructions is vital. Make sure all necessary documents are attached, including form 8995-a schedule c instructions. Tax preparation software, like Turbotax, can help with accuracy.

Meeting deadlines and requirements helps taxpayers avoid penalties. It also ensures they get the qualified business income deduction they deserve. It’s wise to consult a tax professional or use trusted tax software for compliance with form 8995 a instructions and rules.

Conclusion

Form 8995 is key for businesses and individuals wanting to use the qualified business income (QBI) deduction. This guide shows how to fill out Form 8995. It covers who can use it, how to calculate the deduction, and how to avoid mistakes.

With this information, you can handle the Form 8995 filing process well. This helps you save on taxes. It’s important for sole proprietors, partners, and S corporation shareholders to know about 8995a and 8995 tax form.

It’s also important to keep up with tax rules and changes. Knowing the form 8995 instructions and form 8995 example helps. This way, you can use the qbi deduction form to your advantage and improve your tax strategy.

FAQ

What is Form 8995?

Form 8995 is a tax form for claiming the Qualified Business Income (QBI) deduction. This deduction helps reduce taxable income for eligible businesses and individuals.

What is the purpose of the Qualified Business Income Deduction?

The Qualified Business Income Deduction aims to help businesses and individuals with qualified income. It lets them deduct up to 20% of their qualified business income from their taxable income.

Who should use Form 8995?

Those with qualified business income and meet the requirements should use Form 8995. This includes sole proprietors, partners, and S corporation shareholders.

What are the key differences between Form 8995 and Form 8995-A?

Form 8995 is for simpler calculations for those with lower taxable income. Form 8995-A is for more complex situations. Each form has different eligibility rules.

What are the qualification requirements for Form 8995?

To qualify, you must meet income thresholds and have eligible business types. Certain industries and income types are not eligible.

How do I complete Form 8995?

First, gather all necessary documents. Then, follow the guide line-by-line. Make sure to calculate your qualified business income correctly and apply the right deduction percentage.

How is Qualified Business Income calculated?

Calculating Qualified Business Income is key for Form 8995. It involves determining eligible income and using specific calculation methods.

What special considerations are there for pass-through entities?

Pass-through entities like partnerships and S corporations have unique rules. They must follow partnership and S corporation guidelines, and consider multiple businesses.

What are the loss carryforward rules and documentation requirements?

Loss carryforward rules let businesses use net operating losses in future years. Accurate documentation and calculation of these losses are essential for QBI deduction compliance.

What are some common mistakes to avoid when filing Form 8995?

Avoid calculation errors, overlooks in documentation, and filing status mistakes. Paying close attention to detail is key to avoid issues with the QBI deduction.

What are the important deadlines and submission requirements for Form 8995?

The QBI deduction has specific deadlines and requirements. Make sure to meet these to claim the deduction.