Tesla Accounting Red Flags

Key Takeaways: Tesla Accounting Red Flags Financial statements showed areas requiring close attention. A specific $1.4 billion figure drew notable

Key Takeaways: Tesla Accounting Red Flags Financial statements showed areas requiring close attention. A specific $1.4 billion figure drew notable

Key Takeaways Top-rated accounting automation tools handle repetitive tasks like data entry, reconciliations, and report generation. Implementing automation frees up

Key Takeaways on Break-Even Analysis in Management Accounting Break-even analysis finds the point where total revenue equals total costs, meaning

Accounting Jobs Chicago Bank of America: Your Next Career Move? Thinking bout accounting jobs in Chicago? Bank of America is

“`html Key Takeaways Internal auditing plays a crucial role in ensuring the accuracy and reliability of financial information within accounting

Key Takeaways Financial reporting is crucial for effective management accounting, providing insights for decision-making. Accurate financial reports enable better resource

Key Takeaways: Navigating Financial Risks in Accounting 2025 * Understanding financial risks in accounting is more importent than ever in

Key Takeaways: Lean Accounting for Streamlined Business Operations * Lean accounting focuses on eliminating waste and maximizing efficiency in accounting

Key Takeaways: Tesla’s $1.4 Billion Accounting Discrepancy * **Significant Discrepancy:** Tesla’s financial statements are under scrutiny due to a reported

Ethics and Corporate Governance: Do They Really Matter in Accounting Management? Ever wonder, like, what keeps businesses honest, especially when

Key Takeaways Technology has revolutionized modern accounting, making processes more efficient and accurate. Automation in payroll systems reduces errors and

Key Takeaways: Business Codes for Schedule C * Understanding business codes is crucial for accurately completing Schedule C. * Choosing

Key Takeaways Look, buying a house is stressful enough without tax problems hanging over your head. But life happens—maybe you

Key Takeaways Understanding Phantom Tax Basics Ever been taxed on money you never saw? That’s phantom tax in a nutshell,

Key Takeaways Ever wondered who makes those giant yellow bulldozers at construction sites? Or the massive printing presses that pump

Key Takeaways: What Does Tax Topic 152 Mean for Your Refund? Ever checked your refund status and seen “Tax Topic

Businesses have many payroll systems to manage employee pay. This includes different types of payroll software. Knowing these systems is key

Understanding workday pricing is key for businesses to make smart choices. The cost of Workday changes based on the number of employees

Midsize companies in the United States are now using the best HRIS systems. These systems help manage employee data, payroll, benefits,

Gusto payroll pricing is key for businesses wanting to simplify their payroll. Knowing the gusto payroll cost helps companies make smart choices. Gusto’s

A personal bookkeeper offers custom services for individuals. They help with personal finance bookkeeping and provide services tailored to your needs. On the other

Knowing the CPA hourly rate is key for those looking to hire a Certified Public Accountant. The cost can vary a lot,

As an Uber driver, knowing your taxes is key. Uber taxes can be tricky, but with the right info, you can handle

The double declining balance method is a way to quickly write down an asset’s value. It’s used for things like technology or

Knowing the Virginia unemployment pay chart is key for those who have lost their jobs. It shows how much financial help is

Independent contractors need to know the difference between 1099-NEC and 1099-MISC. These forms report different kinds of income to the IRS.

Effective financial management is key in the real estate world. Bookkeeping for real estate agents is vital for keeping accurate financial records. Bookkeeping

An IOLTA trust account is key for lawyers and law firms in the U.S. It helps them manage client money safely and

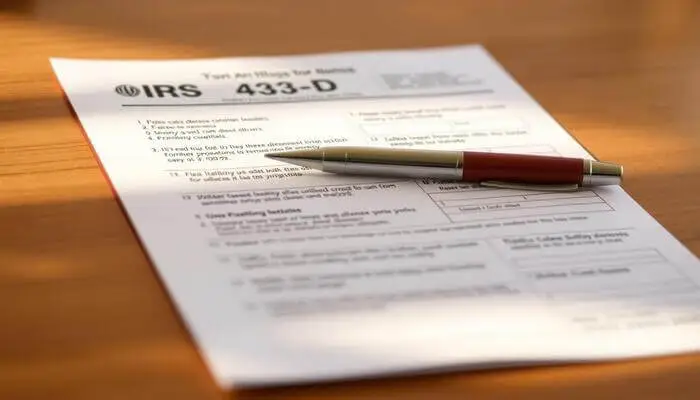

The Internal Revenue Service (IRS) offers a way to pay tax debts through an installment agreement. This can be done

Knowing about financial rights to a business’s assets is key for owners and stakeholders. These rights are vital for running