Understanding business checks can seem tough, but this guide makes it easier. It covers the basics of business checks, like what they look like and how they’re secure. You’ll also learn about the rules for writing and handling them.

This guide also talks about digital payment options. It shows how these alternatives compare to traditional paper checks. You’ll get examples and tips on using both paper and digital checks.

A detailed image of a business check on a wooden desk, featuring a clean and professional design with placeholders for date, payee name, amount in numbers and words, and signature line, alongside a sleek pen and a financial calculator, soft natural lighting illuminating the scene.

Key Takeaways

- Understand the key components and security features of a professional business check

- Learn the standard dimensions and formatting requirements for business checks

- Discover the different types of business checks and their respective uses

- Explore the benefits and considerations of digital payment solutions compared to paper checks

- Implement best practices for effectively managing and utilizing business checks

Understanding Business Check Fundamentals

Business checks are key for managing money in a company. They help make payments and show a business is professional and trustworthy. Knowing about their parts, security, and size is important.

Key Components of a Professional Check

A good business check has the company’s logo, account info, and spaces for the payee’s name and the amount. These parts make sure the check is real and make paying easier.

Security Features and Requirements

Keeping business checks safe from fraud is very important. Checks have special features like watermarks and special inks to stop fake checks. Following rules and standards makes sure checks are legal and valid.

Standard Check Dimensions and Formatting

Checks usually follow certain sizes and layouts. This makes them easy to process and work with banks. The standard size and where important info is placed help payments run smoothly.

Knowing about these basics helps a valid business handle money well. It builds trust with customers and partners.

“Proper check management is essential for maintaining a professional and trustworthy business image.”

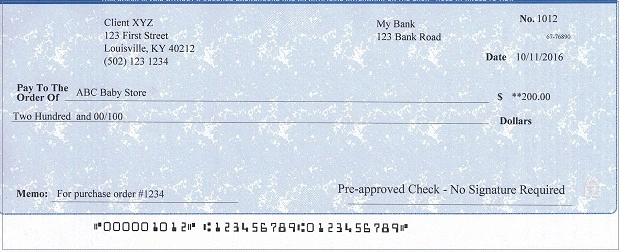

Business Check Example: Essential Elements and Layout

Creating a professional example of a business check requires knowing the key elements and layout. This guide will show you the important parts of a standard business check. It helps make sure your checks are set up right and meet all the rules.

At the top, you’ll see the check number. It’s a unique code for each payment. Below that, there’s the date field for the check’s issue date.

The check’s main part has the payee name. Here, you write the full legal name of who’s getting the money. Next to it, the numeric amount shows the payment amount clearly.

Going down, the written amount field spells out the payment in words. This adds more clarity. At the bottom, the signature line is for the authorized signer’s signature.

Knowing how to arrange these example of a business check parts makes your checks professional and compliant. This ensures they’re processed smoothly.

Common Types of Business Checks and Their Uses

Managing business finances means knowing about different types of checks. Each one has its own use, helping businesses pay bills and keep track of money. This makes payment processes smoother and financial records more accurate.

Standard Business Checks

Standard checks are the most common. They’re for many business needs, like paying vendors and covering daily costs. These checks have the company’s details and security features to fight fraud.

Payroll Checks

Payroll checks are for paying employees. They show the employee’s name, how much they get paid, and details like hours worked. These checks help businesses keep accurate records and follow labor laws.

Voucher Checks

Voucher checks have a detachable stub for detailed records. They’re great for accounts payable, making it easy to track payments. The stub includes vendor info, invoice numbers, and expense breakdowns.

Knowing about these checks helps businesses improve their payment systems. It makes finances clearer and operations smoother.

How to Properly Write and Sign a Business Check

Writing and signing a business check correctly is key for financial transactions. An example of a business check shows what needs to be filled out right. This ensures the check is valid and avoids processing problems. By following a step-by-step guide, businesses can keep their financial records accurate and secure.

When creating an example of business check, start by writing the payee’s full legal name clearly. Make sure to write the amount in both words and numbers. Sign the check with the authorized person’s full legal name and date it correctly. Always double-check the details to prevent mistakes that could slow down or complicate the payment.

- Write the full legal name of the payee

- Clearly indicate the payment amount in words and numerals

- Sign the check using the authorized signatory’s full legal name

- Date the check accurately

- Review all information carefully before finalizing the check

“Attention to detail is crucial when writing a business check to maintain financial integrity and streamline the payment process.”

By following these steps, businesses can make sure their example of business check is filled out, signed, and ready for processing. Keeping accurate and compliant check writing practices is vital for managing financial duties and protecting the company’s reputation.

Digital vs. Paper Business Checks: Modern Payment Solutions

In today’s world, choosing between paper checks and digital payments is key. As a business, you might use both paper checks and payroll checks. But, it’s time to look at digital options more closely.

Electronic Check Processing

Electronic check processing is now a popular choice for businesses. It uses online banking to make payments easier and faster. This method is safer and fits with the trend towards going paperless.

Online Banking Integration

Linking your business banking online brings many benefits. You can automate payments, track funds in real-time, and more. This helps you manage your finances better and avoid the hassle of paper checks.

Security Considerations for Digital Payments

As digital payments grow, so does the need for security. Your electronic check processing and online banking must be protected. Use strong encryption, multi-factor authentication, and fraud prevention to keep your business safe.

Choosing between paper and digital payments is complex. Weigh the pros and cons to decide what’s best for your business. Whether you use standard checks, payroll checks, or other methods, staying updated on payment trends is crucial.

Best Practices for Business Check Management

Managing business checks well is key to keeping finances accurate and safe. By using the best methods, companies can make their check handling smoother and cut down fraud or mistakes. Here are some top strategies for managing business checks effectively.

Meticulous Record-keeping

Keeping detailed records of all check transactions is a must. This means noting down the check number, date, who it’s for, how much, and why. Also, matching your records with bank statements regularly can spot any issues or unauthorized use.

Secure Check Storage and Handling

Keeping blank checks safe is vital to stop them from being used without permission. Business owners should store checks in a locked cabinet or safe, limiting access to only authorized personnel. When giving out checks, make sure they are handled securely and reach the right person.

Fraud Prevention Measures

- Use check-printing software with security features like digital watermarks and microprinting.

- Check bank statements and transaction history often to catch any odd activity.

- Have a two-step process for signing and approving checks to strengthen controls.

By sticking to these best practices for business check example management, companies can keep their finances sound, reduce fraud risks, and make their check handling more efficient. Keeping accurate records, storing checks safely, and being proactive about fraud prevention are essential for good business check management.

A realistic business check displayed prominently on a polished wooden desk, featuring detailed design elements such as the bank logo, signature line, and payment amount, surrounded by office supplies like a pen, calculator, and a notepad, with soft natural lighting enhancing the scene.

“Proper business check management is essential for financial accountability and security.”

Conclusion

This guide has covered all you need to know about managing business checks. We’ve looked at the key parts of a professional check and the different types used for various purposes. Now, you have the knowledge to handle financial transactions securely and efficiently.

Examples of business checks in this article highlight the need to follow standard formats and security measures. By doing so, businesses can protect their finances and build trust with others. This is important for working with vendors, customers, and banks.

As the world of finance changes, businesses must keep up with new payment methods. This includes electronic check processing and online banking. These options bring better security, ease, and help keep records organized. They help businesses stay ahead and meet the demands of today’s digital world.

FAQ

What are the key components of a professional business check?

A professional business check has several key parts. These include the company name and logo, the check number, and the date. It also has the pay-to-the-order-of line, the dollar amount in both numbers and words, and a memo line. Lastly, it requires authorized signatures.

What security features are required on a valid business check?

Valid business checks have several security features. These include microprinting, watermarks, and heat-sensitive ink. They also have unique check numbering. These features help prevent fraud and ensure the check’s authenticity.

What are the standard dimensions and formatting guidelines for a business check?

Business checks are usually 8.5 inches by 3.66 inches. They follow a standard layout. This includes the MICR line, check number, and payee information in specific places.

Which examples illustrate a valid business check?

A valid business check is shown by examples. These include the company’s name and logo, secure design elements, and proper formatting. This includes the date, pay-to-the-order-of line, and authorized signatures.

What are the different types of business checks and their respective uses?

There are several types of business checks. Standard checks are for general use. Payroll checks pay employees. Voucher checks have a detachable stub for records.

How should a business check be properly written and signed?

To write and sign a business check right, start with the date. Then, write the payee’s name and the dollar amount in both numbers and words. Don’t forget the authorized signatures. Paying attention to detail is key to avoid fraud.

What are the key considerations when transitioning from paper to digital business checks?

Switching to digital business checks requires careful thought. Consider electronic processing and online banking integration. Also, ensure strong security to prevent fraud. Digital payments are convenient but need careful management.

What are the best practices for effective business check management?

Effective check management involves several steps. Keep accurate records and reconcile accounts often. Use fraud prevention strategies like positive pay and check stock security. Good check management ensures financial accuracy and reduces errors or misuse.