Did you know over 17 billion business checks are written in the U.S. every year? These checks are key in modern business, helping with safe transactions and keeping financial records. This guide will dive deep into Business Check Example, covering what they are, their security, and how to use them right.

A realistic business check on a wooden desk, featuring intricate designs and security features, with an elegant pen beside it, soft natural lighting casting shadows, a blurred financial document in the background, emphasizing professionalism and attention to detail.

Key Takeaways

- Business checks are essential financial instruments that facilitate secure transactions and record-keeping for businesses.

- Understanding the key components, security features, and types of business checks is critical for proper usage and compliance.

- Proper documentation, legal compliance, and considerations between digital and paper checks are important to avoid common mistakes.

- Utilizing business checks offers numerous benefits, including improved financial management, fraud prevention, and professional presentation.

- Staying up-to-date with the latest trends and best practices in business check usage is crucial for businesses to remain competitive and compliant.

Understanding Business Check Fundamentals

A valid business often uses well-designed business checks. These tools are key for managing daily operations, ensuring secure transactions, and keeping records accurate. It’s vital to know about their components, security features, and types.

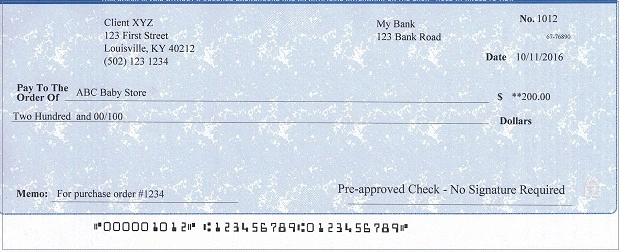

Essential Components of a Business Check Example

A standard Business Check Example has several important parts:

- Account information: This includes the business name, address, and account number, which helps identify the payer.

- Payee line: This is where the recipient’s name is written, indicating the check’s intended beneficiary.

- Amount in numbers: The exact dollar amount of the check is clearly displayed in numerical form.

- Amount in words: The dollar amount is also written out in words to prevent tampering or fraud.

- Signature line: The authorized signatory of the business must sign the check to validate the payment.

Security Features and Requirements

Business checks have security features to prevent fraud and ensure transaction integrity. These include:

- Microprinting: Tiny, intricate text that is difficult to replicate, adding an extra layer of protection.

- Watermarks: Faint images or patterns visible when held up to the light, making it challenging to counterfeit.

- Chemical sensitivity: The check paper is designed to react to chemical tampering, alerting the recipient of any unauthorized alterations.

Different Types of Business Checks

Businesses have several check options, each for a specific use:

- Standard business checks: These are the most common type used for general business transactions.

- Payroll checks: Designed specifically for employee paychecks, with additional information like pay period and withholdings.

- Voucher checks: Incorporate a detachable stub or voucher that provides a record of the payment, making it easier to track and reconcile transactions.

Knowing the basics of business checks is key for financial integrity and compliance.

Business Check Example: Key Elements and Layout

Knowing the key parts and layout of a business check is key for smooth processing and avoiding errors. Let’s explore a typical example of a business check and what it must have.

At the top, you’ll see the date line. Here, you write the date the check was issued. This is important for tracking payments and preventing problems. Next, there’s the pay-to-the-order-of field. This is where you write the name of who the check is for, making sure it’s correct.

The dollar amount, both in numbers and words, is very important. It must be filled in carefully. This way, there’s no confusion. The memo field, though optional, is useful for noting the payment’s purpose. It helps keep records clear and open.

| Check Element | Purpose |

|---|---|

| Date Line | Indicates the date of issuance |

| Pay-to-the-Order-of | Identifies the payee |

| Dollar Amount (Numeric and Written) | Specifies the payment amount |

| Memo Field | Provides a reference for the payment |

| Routing Number | Identifies the bank and facilitates electronic processing |

| Account Number | Designates the specific bank account |

The routing and account numbers at the bottom help identify the bank and account. They make electronic payments work smoothly and ensure payments are made right and on time.

By knowing the important parts and layout of a business check example, companies can make payments better, keep records right, and follow financial rules.

A detailed illustration of a business check, showcasing a professional layout with an emphasis on key elements such as the payee line, date line, amount box, and signature area. The design should feature a subtle background texture, with a clean and modern aesthetic, incorporating a realistic depiction of paper texture and ink details.

Common Mistakes to Avoid When Writing Business Checks

Writing accurate and compliant business checks is key for keeping financial records right. Yet, many businesses make mistakes that can cost a lot. We’ll look at the main areas where businesses need to be careful to avoid errors.

Proper Documentation and Record Keeping

Keeping detailed records of checks is vital. Not keeping track of check numbers, who they’re for, and how much can cause problems. Businesses should have a good system for keeping all check records, both physical and digital.

Legal Compliance and Best Practices

Following legal rules and best practices is crucial for writing checks. Checks must have the right details like date, payee name, and amount. Not doing this can lead to fraud, disputes, and financial issues.

Digital vs. Paper Check Considerations

- Businesses need to think about the pros and cons of digital vs. paper checks. Digital checks are fast and safe but need strong security. Paper checks offer a physical record but must be kept safe.

- Paper checks are good for some payments but need careful handling. Businesses must keep them secure and record them accurately.

By knowing and fixing these common mistakes, businesses can protect their money. They can improve their check-writing and avoid big problems.

Benefits of Using Business Checks in Modern Commerce

In today’s digital world, business checks are still a solid choice for companies big and small. They help both local shops and big corporations manage their money well. Business checks are key in today’s business world.

Business checks give companies better control over their money. They use numbered checks to keep track of payments. This makes it easier to manage money and keep accounts straight. It’s important for any business to be transparent and accountable.

Also, business checks make a company look more professional. A well-made check shows a business is trustworthy. This is important when meeting new customers or suppliers. It helps a business stand out and build strong relationships.

| Benefit | Description |

|---|---|

| Financial Control | Businesses can maintain a clear record of transactions and manage cash flow more effectively. |

| Professional Image | Personalized business checks convey a sense of legitimacy and trustworthiness. |

| Documentation | Business checks serve as a valid form of payment and documentation for various business scenarios. |

Finally, business checks are also useful for keeping records. They are great for paying vendors or for other financial needs. They provide solid proof of transactions, which is important for keeping records and following the law.

In summary, business checks offer many benefits in today’s business world. They help with money management, look professional, and keep records. By using business checks, companies can succeed in the changing business landscape.

Conclusion

This guide has shown how important business checks are today. They help businesses understand the key parts and safety features of checks. They also learn about the different types of checks available.

By following the best practices for writing and managing checks, businesses can avoid mistakes and fraud. They can choose between digital or paper checks. The main thing is to keep accurate records and follow the rules.

This approach builds trust and makes operations smoother. It also protects the company’s money. Business checks are still a key tool in today’s business world.

Learning about business checks helps companies build a strong financial base. It makes them more trustworthy and ready to handle today’s business challenges.

FAQ

What are the essential components of a business check?

A business check must have key parts. These include the account info, where to write the payee’s name, and a spot for your signature. It also needs the date, check number, and the amount you’re paying.

What security features are typically included in business checks?

Business checks have special security features. These include microprinting, watermarks, and other anti-fraud elements. They help prevent counterfeiting and unauthorized use.

What are the different types of business checks available?

There are many types of business checks. You can get standard checks, payroll checks, and voucher checks. Each type has its own features and uses.

What are the key elements to consider when writing a business check?

When writing a business check, make sure to place information correctly. Your handwriting should be clear. Also, use the right date format and follow any legal rules.

How do digital checks compare to traditional paper checks in modern commerce?

Digital checks are convenient and efficient. But, paper checks are still valid for certain business needs. They have their own benefits and things to consider.